Common Accounting Mistakes to Avoid for Small Business Owners

Starting and running a small business is an exciting venture, but it comes with its fair share of challenges, especially in the realm of accounting. Keeping your financial records accurate and up-to-date is crucial for the success and sustainability of your business. Unfortunately, many small business owners fall into common accounting traps that can lead…

Read MoreMastering Payroll: Essential Compliance and Best Practices for Businesses

Navigating payroll can be a daunting task for businesses of all sizes. From calculating wages to ensuring compliance with ever-changing regulations, there’s a lot to consider. In this blog post, we’ll explore the complexities of payroll and provide insights into best practices to help businesses streamline their payroll processes and maintain compliance. Understanding Payroll Compliance:…

Read MoreThe Benefits of Outsourcing Your Bookkeeping: How It Saves Time and Money

In today’s fast-paced business world, entrepreneurs and small business owners wear many hats. From managing operations to driving sales, their to-do lists seem never-ending. However, one crucial aspect of running a successful business often gets overlooked – bookkeeping. While some may attempt to manage their finances in-house, outsourcing bookkeeping services can offer numerous benefits, ultimately…

Read MoreDemystifying Financial Statements: A Comprehensive Guide for Entrepreneurs

Financial statements are the lifeblood of any business, serving as vital tools for decision-making and financial management. Yet, for many entrepreneurs, deciphering these statements can feel like decoding a foreign language. In this guide, we’ll unravel the complexities of financial statements, empowering entrepreneurs to understand, interpret, and leverage these essential documents effectively. Understanding Financial Statements:…

Read MoreTax Tips for Small Businesses: Maximizing Deductions

As tax season approaches, small business owners are looking for every opportunity to minimize their tax liability and maximize their deductions. Understanding the intricacies of tax law and knowing which expenses qualify for deductions can make a significant difference in your bottom line. In this blog post, we’ll explore some valuable tax tips for small…

Read MoreBe Prepared: Your 2023 Tax Refund Could Be Smaller & Delayed

Many people rely on their tax refunds to purchase larger expenses or pay off debt. Others look forward to placing the lump sum return in their savings account for a bit of a financial cushion. Unfortunately, your ability to do any of these things with your 2023 refund may be hindered since the amounts received…

Read MoreWant to Access Your Tax Documents? Facial Recognition Will Be Required

Online security is important for keeping your private information out of the hands of people who shouldn’t have access to it. One way that the IRS is planning to protect your tax information is with facial recognition. IRS Reveals New Facial Recognition Tool On November 17, 2021, the IRS revealed that it is launching a…

Read MoreTax Changes Under the Build Back Better Plan

The current version of President Biden’s Build Back Better plan includes several changes, some of which include increasing Medicaid availability in certain states, limiting childcare costs for families with young children, and providing free schooling for pre-K students. If enacted, it would also result in a few tax-related changes for the 2022 tax year and…

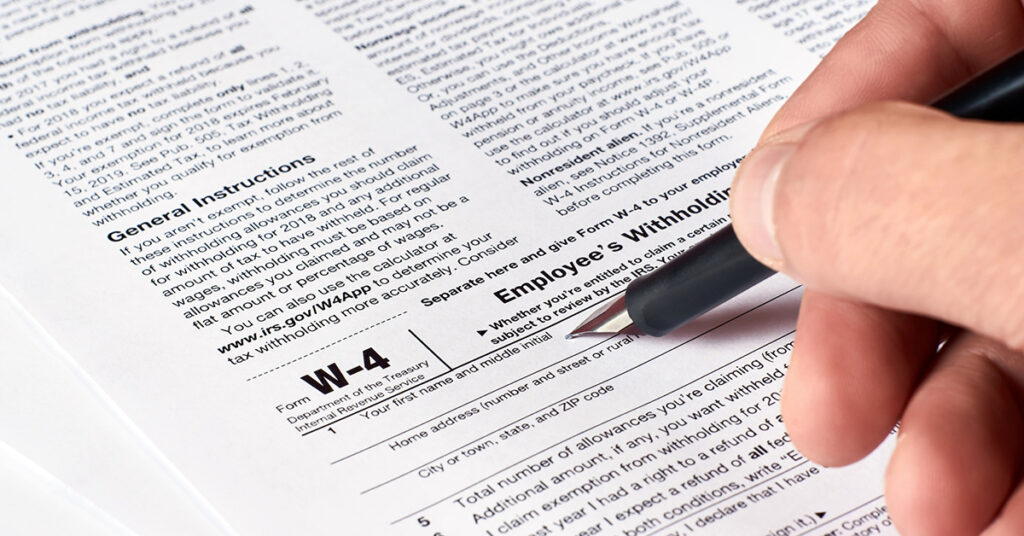

Read MoreHow to Fill Out a W-4 Form Correctly

The W-4 form tells your employer how much it should withhold from your check for federal income tax purposes. Filling it out correctly can prevent you from paying too little or too much throughout the year. Here’s what you need to know when completing your W-4. Step 1 Enter your first name and middle initial,…

Read MoreTax Planning for 2021: What You Need to Know

There are only two months left to prepare and plan for your 2021 tax filings. At Sherman & Associates, we want to make this process as simple and painless as possible. So, here’s what you need to know as you are getting ready to finish up the 2021 tax year. The Child Tax Credit Has…

Read More